No preapproval is required for an individual income tax credit for a residential solar energy device tax credit that is claimed on form 310.

Arizona state tax credit for solar panels.

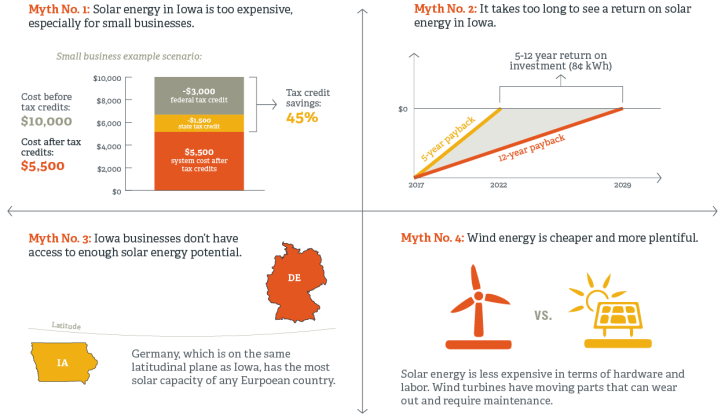

2 while generous sun is the biggest factor arizona s solar incentives and the federal solar tax credit help to contribute to its competitive solar capacity.

That is a significant amount of savings on your income taxes.

Form year form.

Arizona state energy tax credits.

Arizona solar energy tax credit.

Not only do arizona residents get to take advantage of the federal tax credit but they can also receive the state s solar energy credit.

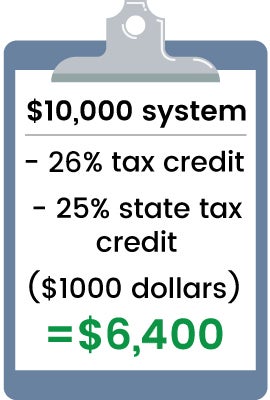

Arizona offers state solar tax credits 25 of the total system cost up to 1000.

Residential arizona solar tax credit.

This credit offers 25 off the gross cost of the system up to a maximum credit of 1 000.

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayer s residence located in arizona.

The most significant solar rebate offered in arizona is the credit for solar energy devices from the arizona department of revenue.

As one of the sunniest states in the country arizona is a paradise when it comes to solar power.

There are several arizona solar tax credits and exemptions that can help you go solar.

Arizona s solar energy credit is equal to 25 of the costs of a solar system up to 1 000.

Arizona state tax credit for solar.

After claiming the 26 federal solar tax credit and arizona s state tax credit the price is only 2 00 per watt.

The top rated arizona solar tax credit and state incentives.

The residential arizona solar tax credit reimburses you 25 percent of the cost of your solar panels up to 1 000 right off of your personal income tax in the.

1 so it s no surprise that it consistently ranks in the top 10 solar states in the u s.

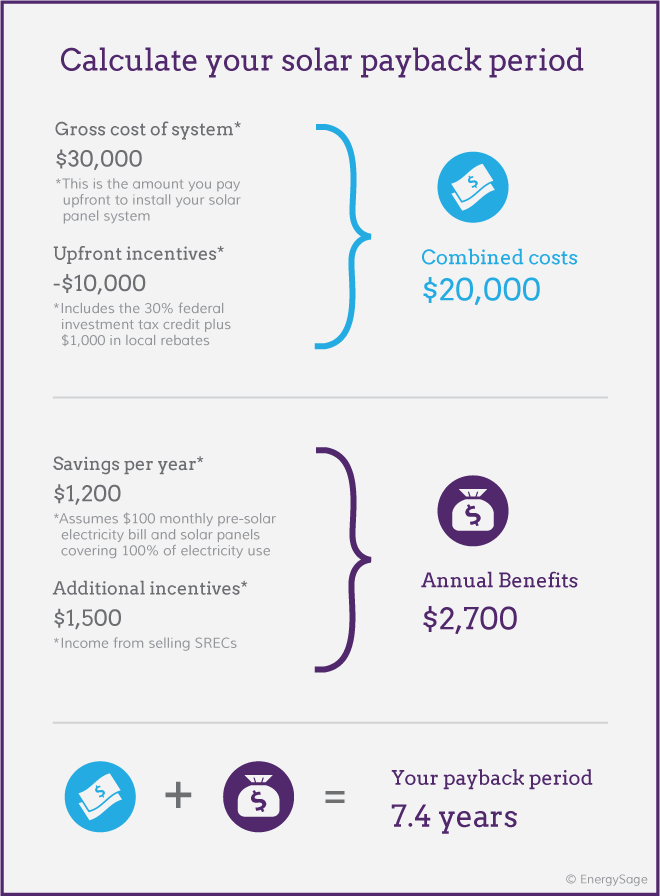

This puts the average cost of a 5kw system at 13 958 before incentives and 9 325 after claiming incentives.

You can claim the credit for your primary residence vacation home and for either an existing structure or.